The latest Monthly Per Capita Consumption Expenditure (MPCE) survey by the National Sample Survey Office (NSSO) reveals significant insights into spending patterns in rural India. The survey highlights a narrowing gap between rural and urban consumption, with rural areas showing a higher growth rate in expenditure. The study also examines state-wise performance, noting that southern and western states have higher MPCEs than the national average, while some eastern states lag. This data is crucial for policy formulation and market strategies, as it helps identify areas in need of targeted interventions and investment.

Origin of the Article

This editorial is based on “What’s driving rural spending?” published in The Business Line on 02/07/2024. The article examines the NSSO’s MPCE survey, highlighting reduced rural-urban consumption disparities, state-wise performance, and the impact of government transfers on rural spending.

Relevancy for UPSC Students

For UPSC aspirants, understanding the MPCE survey is crucial as it covers topics in GS Paper 2 and 3 like Government Policies, Growth, and Inclusive Development. It aids in comprehending rural-urban disparities and economic planning, essential for the examination.

Why in News

The Monthly Per Capita Consumption Expenditure (MPCE) survey by NSSO has recently gained attention for revealing a significant reduction in the rural-urban consumption gap. This survey holds importance for UPSC aspirants as it provides critical insights into economic disparities, government policies like PM-Kisan and NREGA, and the socioeconomic conditions influencing rural consumption patterns. Understanding these dynamics is essential for addressing questions on economic development, policy efficacy, and rural-urban divides, all of which are recurring themes in the UPSC exams.

Findings of the Monthly Per Capita Consumption Expenditure (MPCE) Survey

The Monthly Per Capita Consumption Expenditure (MPCE) survey, conducted by the National Sample Survey Office (NSSO), reveals key trends in consumption patterns across India. It highlights a significant reduction in the rural-urban divide, notable state-wise performance, and varying consumption growth rates. These insights are crucial for policymakers, economists, and businesses aiming to understand and address economic disparities.

Reduction in Rural-Urban Divide

The MPCE survey indicates a decrease in the gap between urban and rural consumption, from 84% to 75% over 11 years. This reduction underscores the progress in the rural economy, reflecting improvements in rural populations’ economic well-being and consumption patterns.

Comparison of Growth Rates

The survey shows that the compound annual growth rate (CAGR) of rural MPCE stands at 4.7%, compared to 2.7% in urban areas. This indicates that rural areas have experienced faster economic growth, highlighting a shift towards more balanced regional development.

State-wise Performance Comparison

The MPCE survey also reveals disparities in rural consumption across states. Some states, such as Kerala and Punjab, perform significantly better than others, like Chhattisgarh and Jharkhand. Understanding these differences is crucial for targeted policy interventions to address regional disparities.

- States Above National Average: Kerala leads with an MPCE of ₹5,924, followed by states like Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, Punjab, Haryana, Maharashtra, Gujarat, and Rajasthan. These states have MPCEs higher than the national average, reflecting their relatively better economic conditions.

- States Below National Average: Chhattisgarh, Jharkhand, and Odisha have MPCEs significantly lower than the national average. Rajasthan, although performing well in rural MPCE, falls below the urban national average, indicating a need for focused economic interventions.

- Bottom Tier States: Madhya Pradesh, Bihar, and Jharkhand have urban MPCEs below ₹5,000, placing them in the bottom tier for urban consumption. This reflects limited formalization and industrialization in these states, affecting their urban income and consumption levels.

Stark Disparity

The survey highlights significant disparities in MPCE across states, suggesting uneven rural development. These disparities necessitate targeted policy interventions to address lower consumption and the underlying issues in states that are lagging behind.

Factors Influencing Rural Consumption Pattern

Several factors influence rural consumption patterns, including government cash transfers, urban migration, and savings rates. These elements collectively shape the economic landscape of rural India, impacting how rural households allocate their resources.

Government Cash Transfers

Government initiatives like PM-Kisan and NREGA have significantly boosted rural spending power. These cash transfers and subsidies enhance the purchasing power of rural households, leading to increased consumption and economic activity.

Urban Migration and Remittances

Urban migration has resulted in increased remittances to rural areas. This inflow of money boosts rural consumption, as families receive financial support from members working in urban centers, thereby enhancing their spending capacity.

Lower Savings Rates in Rural Areas

Rural areas exhibit lower savings rates compared to urban regions, as evidenced by the concentration of bank deposits in cities. This lower propensity to save translates into higher consumption growth in rural areas, driving economic activity.

Challenges that Still Persist Related to Rural Consumption Pattern

Despite improvements, several challenges persist in rural consumption patterns, including agricultural dependence, environmental challenges, and limited access to credit. Addressing these issues is vital for sustainable rural development.

Agricultural Dependence & Seasonal Employment

Rural incomes heavily depend on agriculture, which is susceptible to weather, pests, and market fluctuations. Seasonal employment further exacerbates income volatility, leading to periods of financial uncertainty for rural households.

Environmental and Climatic Challenges

Erratic weather patterns and climate change adversely affect rural areas, impacting agricultural productivity and income. These environmental challenges necessitate adaptive measures to safeguard rural livelihoods and ensure food security.

Limited Access to Credit

Many rural households lack access to formal banking services, relying instead on informal moneylenders who charge high-interest rates. This limited access to credit hampers their ability to invest in income-generating activities and purchase goods.

Higher Inflation

High inflation erodes the purchasing power of rural households, reducing their consumption expenditure. Rural retail inflation, still over 5% as of May 2024, poses a significant challenge to maintaining consumption levels in these areas.

Paradox of Thrift

Higher savings due to inflation can dampen current consumption levels. Households allocate more income towards savings rather than spending on goods and services, which can slow economic growth in the short term.

Inadequate Infrastructure

Many rural areas lack adequate infrastructure, such as roads, transport, and communication networks. This limits market access, reduces productivity, and hinders the overall economic development of these regions.

PESTEL Analysis

| Political: Government policies such as cash transfer programs (e.g., PM-Kisan, NREGA) have directly influenced rural spending by increasing disposable income among rural households. Political stability and policy continuity are crucial for maintaining and expanding these initiatives. Economic: The economic landscape, characterized by a narrowing urban-rural spending gap and rising rural incomes, suggests growing economic parity. However, rural areas still face challenges like high dependence on agriculture, fluctuating incomes, and higher inflation rates, which can undermine spending capacity. Social: Social dynamics, including urban migration and remittances, significantly impact rural spending. These remittances increase liquidity in rural markets but also highlight the dependency on urban economic health. Additionally, lower savings rates in rural areas suggest a potential for higher consumption but also underline financial vulnerability. Technological: Advancements in digital payment systems and internet connectivity are crucial for enhancing economic activity in rural areas. Improved technology adoption can lead to better financial inclusion and access to markets, stimulating consumption and economic growth. Environmental: Environmental and climatic challenges, especially erratic weather patterns affecting agriculture, directly impact rural incomes and spending. These factors necessitate robust environmental planning and support for rural communities to mitigate impacts on consumption. Legal: Access to credit remains a significant issue, with many rural households relying on informal lenders due to inadequate legal frameworks for financial inclusion. Enhancing legal provisions for rural financial services could improve spending patterns in rural India by providing more stable and affordable credit options. |

What Can Be Done to Enhance Rural Consumption Expenditure?

Enhancing rural consumption expenditure requires strategic measures, including optimized marketing strategies, balanced regional development, financial inclusion, and infrastructure improvements. These efforts can drive sustainable economic growth in rural areas.

Optimising Marketing Strategies

Consumer goods companies need to tailor their marketing strategies to the varying rural-urban consumption differentials across states. Understanding specific consumption patterns and economic conditions is essential for effective market penetration and consumer engagement.

Balanced Regional Development

Targeted policies that promote equitable economic development across regions are crucial. Affirmative actions, such as subsidies and welfare schemes, can help bridge the consumption gap and ensure balanced growth.

Financial Inclusion and Digital Payments

Promoting financial literacy and expanding digital payment infrastructure in rural areas can reduce cash dependence and stimulate transactions. Initiatives like UPI and AePS enhance convenience and boost overall consumption.

Infrastructure Development

Improving rural infrastructure, such as roads, electrification, and internet connectivity, can facilitate easier access to markets and services. Initiatives like BharatNet are pivotal in boosting economic activity and consumption.

Financial Inclusion Innovations

Introducing innovative financial products, such as micro-insurance and crop insurance, tailored to rural needs can build resilience. These products encourage higher investment in consumption goods, driving economic growth.

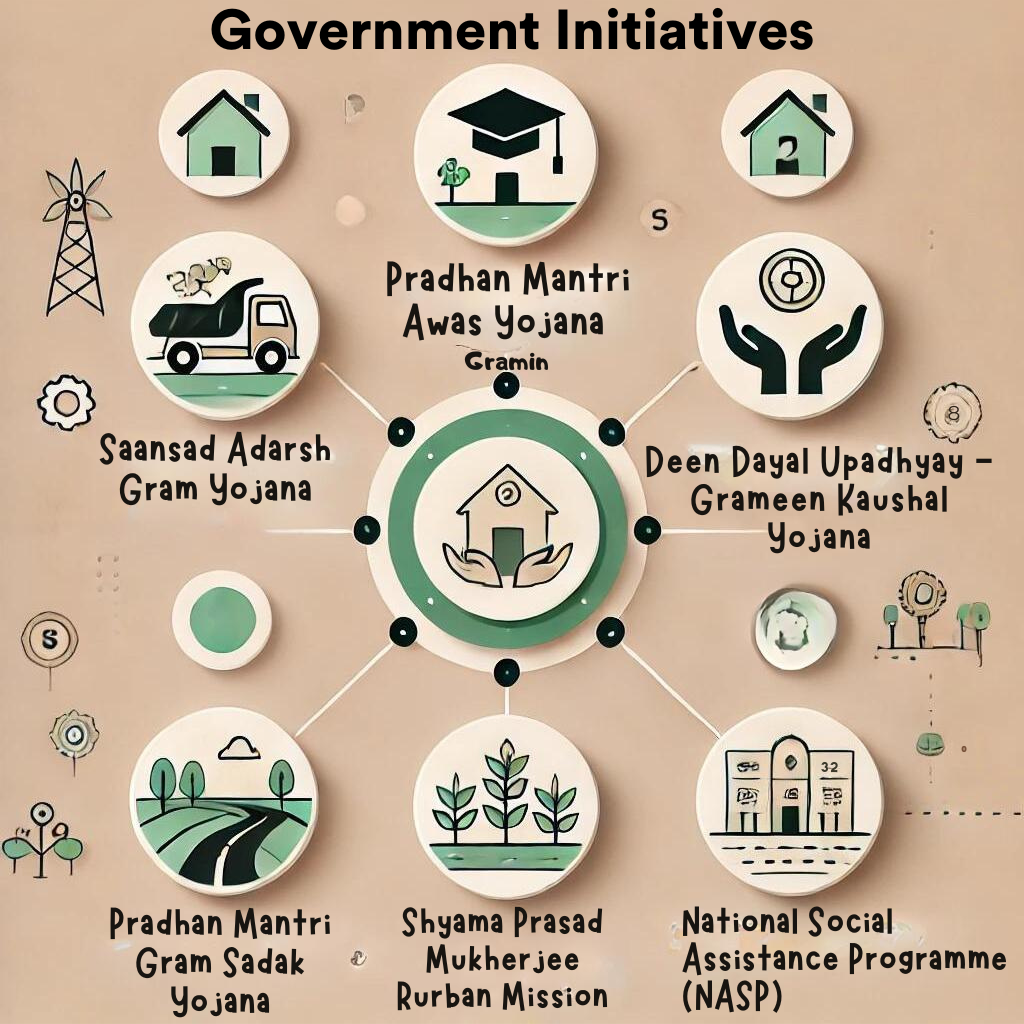

Initiatives Related to Rural Development

Various government initiatives aim to enhance rural development, focusing on housing, roads, skill development, and social assistance. These programs play a crucial role in improving the living standards of rural populations.

Pradhan Mantri Awas Yojana – Gramin

This housing scheme aims to provide affordable housing to the rural poor, ensuring dignified living conditions and improving overall well-being.

Pradhan Mantri Gram Sadak Yojana

Focused on improving rural road connectivity, this scheme facilitates better access to markets and services, boosting economic activity in rural areas.

Deen Dayal Upadhyay – Grameen Kaushal Yojana

This skill development program enhances the employability of rural youth, equipping them with the necessary skills to secure better job opportunities.

National Social Assistance Programme (NASP)

NASP provides financial support to the elderly, widows, and disabled, ensuring social security and enhancing the quality of life for vulnerable populations.

Saansad Adarsh Gram Yojana

This initiative aims to develop model villages through the leadership of Members of Parliament (MPs), promoting holistic and sustainable rural development.

Shyama Prasad Mukherjee Rurban Mission

The mission focuses on developing rural areas with urban amenities, bridging the gap between rural and urban living standards, and fostering inclusive growth.

Conclusion

The MPCE survey provides a critical lens through which we can understand the dynamics of rural and urban consumption in India. Highlighting the reduced rural-urban divide and the influence of government interventions, it underscores the importance of targeted policies for balanced regional development. Civil services aspirants must grasp these insights to effectively contribute to policy-making that fosters inclusive growth and equitable development.

| UPSC Civil Services Examination, Previous Year Questions (PYQs) Mains Q. Critically examine whether growing population is the cause of poverty OR poverty is the main cause of population increase in India. (GS Paper I, 2022). Q. Discuss the impact of the PM-Kisan scheme on the socio-economic status of small and marginal farmers in India. Evaluate the challenges faced in the implementation of the scheme and suggest measures for improvement. |