1. Historical Evolution of the Financial Services Sector

The financial services sector in India has undergone significant transformations over the decades, evolving through various phases marked by policy changes, technological advancements, and regulatory reforms.

Pre-Independence Era

Before independence, India’s financial sector was primarily focused on serving the British colonial interests. The sector was characterized by a few British-controlled banks, limited access to credit for Indian businesses, and underdeveloped capital markets.

Post-Independence Era (1947-1991)

- Nationalization of Banks: In 1949, the Reserve Bank of India (RBI) was nationalized, and in 1969, 14 major commercial banks were nationalized, followed by six more in 1980. This aimed to extend banking services to rural areas and ensure credit availability for agriculture and small industries.

- Development of Financial Institutions: The establishment of institutions like the Industrial Finance Corporation of India (IFCI) in 1948 and the Industrial Development Bank of India (IDBI) in 1964 aimed to provide long-term financing for industrial projects.

Liberalization and Reforms (1991-Present)

The economic crisis of 1991 prompted significant liberalization and reforms in the financial sector:

- Deregulation: The government initiated reforms to deregulate interest rates, reduce statutory liquidity ratios (SLR), and promote competition.

- Entry of Private Players: The entry of private sector banks, both domestic and foreign, brought competition, efficiency, and innovation.

- Capital Market Reforms: Establishment of the Securities and Exchange Board of India (SEBI) in 1992 to regulate and develop capital markets, introduction of electronic trading, and dematerialization of shares.

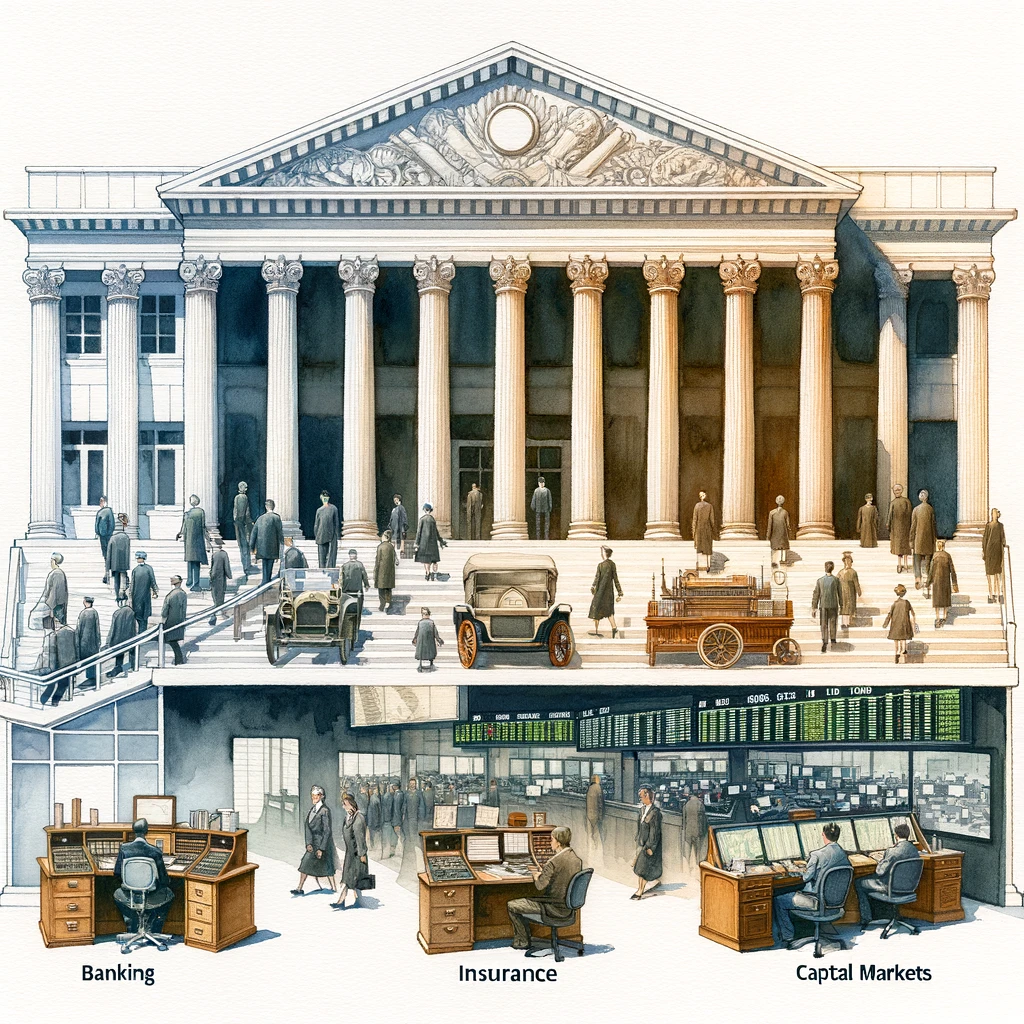

2. Key Components of the Financial Services Sector

Banking

- Commercial Banks: Includes public sector banks (PSBs), private sector banks, foreign banks, and regional rural banks (RRBs). They provide a wide range of services including loans, deposits, and payment services.

- Cooperative Banks: Operate on a cooperative basis and are an important part of the rural credit system.

- Non-Banking Financial Companies (NBFCs): Provide banking services without holding a banking license, focusing on loans and credit facilities, asset financing, and other financial activities.

Insurance

- Life Insurance: Dominated by Life Insurance Corporation of India (LIC) until the entry of private players post-2000. The sector now includes several private life insurance companies.

- General Insurance: Includes companies providing non-life insurance services such as health, motor, property, and liability insurance.

- Regulation: The Insurance Regulatory and Development Authority of India (IRDAI) oversees the insurance sector, ensuring its orderly growth and protecting policyholders’ interests.

Capital Markets

- Stock Exchanges: The Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) are the primary stock exchanges in India, facilitating equity trading.

- Debt Market: Involves trading in government securities, corporate bonds, and other debt instruments.

- Mutual Funds: Pools of funds collected from investors for investment in securities, managed by asset management companies (AMCs).

- Regulation: SEBI regulates capital markets, ensuring transparency, investor protection, and orderly development.

3. Recent Trends and Developments

Fintech

- Digital Payments: The rise of digital payment platforms like Paytm, PhonePe, and Google Pay has transformed the payments landscape. Unified Payments Interface (UPI) has become a popular mode of digital transactions.

- Lending Platforms: Peer-to-peer (P2P) lending and digital lending platforms offer quick and hassle-free loans, leveraging technology to assess creditworthiness.

- Blockchain and Cryptocurrencies: Blockchain technology is being explored for secure and transparent financial transactions, while cryptocurrencies have gained attention as alternative investment avenues.

Digital Banking

- Mobile Banking: Mobile banking apps provided by banks enable customers to perform banking transactions on their smartphones, enhancing convenience.

- Neobanks: Digital-only banks without physical branches, such as Niyo and Open, offer banking services primarily through mobile and web applications.

- Robo-Advisors: Automated platforms providing financial advice and investment management services using algorithms.

4. Regulatory Framework and Reforms

Banking Sector

- Reserve Bank of India (RBI): The central bank regulates monetary policy, issues currency, and oversees the banking sector’s stability and growth.

- Basel III Norms: Implementation of Basel III guidelines to enhance the banking sector’s resilience by improving capital adequacy, leverage ratios, and liquidity.

Insurance Sector

- Insurance Regulatory and Development Authority of India (IRDAI): Regulates and promotes the insurance industry, ensuring fair practices and protecting policyholders.

- Solvency Norms: Ensuring insurance companies maintain adequate solvency margins to meet their obligations.

Capital Markets

- Securities and Exchange Board of India (SEBI): Regulates stock exchanges, mutual funds, and market intermediaries, ensuring investor protection and market integrity.

- Reforms: Introduction of new instruments like Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) to diversify investment opportunities.

5. Challenges and Future Outlook

Challenges

- Non-Performing Assets (NPAs): High levels of NPAs in the banking sector, particularly in public sector banks, affect profitability and capital adequacy.

- Financial Inclusion: Despite progress, a significant portion of the population still lacks access to formal financial services, particularly in rural areas.

- Cybersecurity: The increasing digitization of financial services poses risks related to data security and cyber fraud.

- Regulatory Compliance: Navigating complex and evolving regulatory requirements can be challenging for financial institutions.

Future Outlook

- Technological Integration: Continued adoption of emerging technologies like AI, machine learning, and blockchain will drive innovation and efficiency in financial services.

- Financial Inclusion Initiatives: Government and regulatory efforts to enhance financial inclusion will expand access to financial services, particularly in underserved regions.

- Sustainable Finance: Growing focus on environmental, social, and governance (ESG) criteria will influence investment decisions and financial products.

- Regulatory Evolution: Ongoing reforms and regulatory updates will ensure the sector’s stability, transparency, and alignment with global standards.

Conclusion

The financial services sector in India has evolved significantly, driven by policy reforms, technological advancements, and regulatory oversight. While challenges like NPAs, financial inclusion, and cybersecurity persist, the sector’s future remains promising with continued innovation, regulatory support, and a focus on sustainable finance. The sector’s growth will play a crucial role in India’s economic development, offering diverse opportunities for stakeholders and enhancing the financial well-being of the population.