India stands at a critical point in its climate journey. Of all the policies that have made the most recent move, from setting an energy efficiency target to an emission target, this one may well be the most important, with the stated objective being the establishment of a carbon market in which the country would balance its climate goals against its development needs—most notably iron and steel, which are the biggest polluters. It is the third-largest emitter in the world and needs to walk the tightrope between reducing its emissions and growing its economy. This, in turn, establishes a carbon market and reveals that India is committed to solutions for emission reduction by market mechanisms. However, putting in place a carbon market that resonates with developmental priorities while achieving substantial emission reductions will need cautious planning.

| GS Paper | General Studies III |

| Topics for UPSC Prelims | Perform Achieve and Trade scheme, Nationally Determined Contributions, Carbon Credits, Carbon Taxes, World Bank’s State and Trends of Carbon Pricing 2024, Carbon Credits Trading Scheme, Electricity Conservation Act, 2001, Bureau of Energy Efficiency, International Monetary Fund, Carbon footprint, India’s industrial sector, Carbon Border Adjustment Mechanism, World Economic Forum. |

| Topics for UPSC Mains | Current Government Initiatives Related to the Carbon Market in India, Advantages of Implementing a Carbon Tax, Major Challenges Related to Carbon Taxation in India. |

Origin of the Article

This editorial is based on “Establishing a carbon market” published in The Hindu on 29/08/2024. The article discusses India’s transition from energy efficiency targets under the PAT scheme to establishing its own carbon market.

Relevancy for UPSC Students

Understanding India’s carbon market is crucial for UPSC aspirants as it relates to GS Paper 3 topics like conservation, renewable energy, and government policies. Knowledge of carbon credits, taxes, and current government initiatives will aid in comprehending India’s environmental strategies and economic implications, which are essential for both prelims and mains preparation.

Why in News

The transition to establishing a carbon market in India is crucial for UPSC aspirants to understand, given its implications on climate policy, economic development, and international commitments. This topic is particularly relevant as it links with previous UPSC questions on carbon credits, environmental policies, and global climate agreements, thereby offering a comprehensive view of India’s evolving environmental strategy.

What is the Carbon Market?

Carbon markets are mechanisms designed to reduce greenhouse gas emissions through financial incentives. These markets operate on the principle of cap-and-trade, where a regulatory body sets a cap on emissions. Entities must purchase carbon credits to offset emissions, creating a market-driven approach to emission reduction.

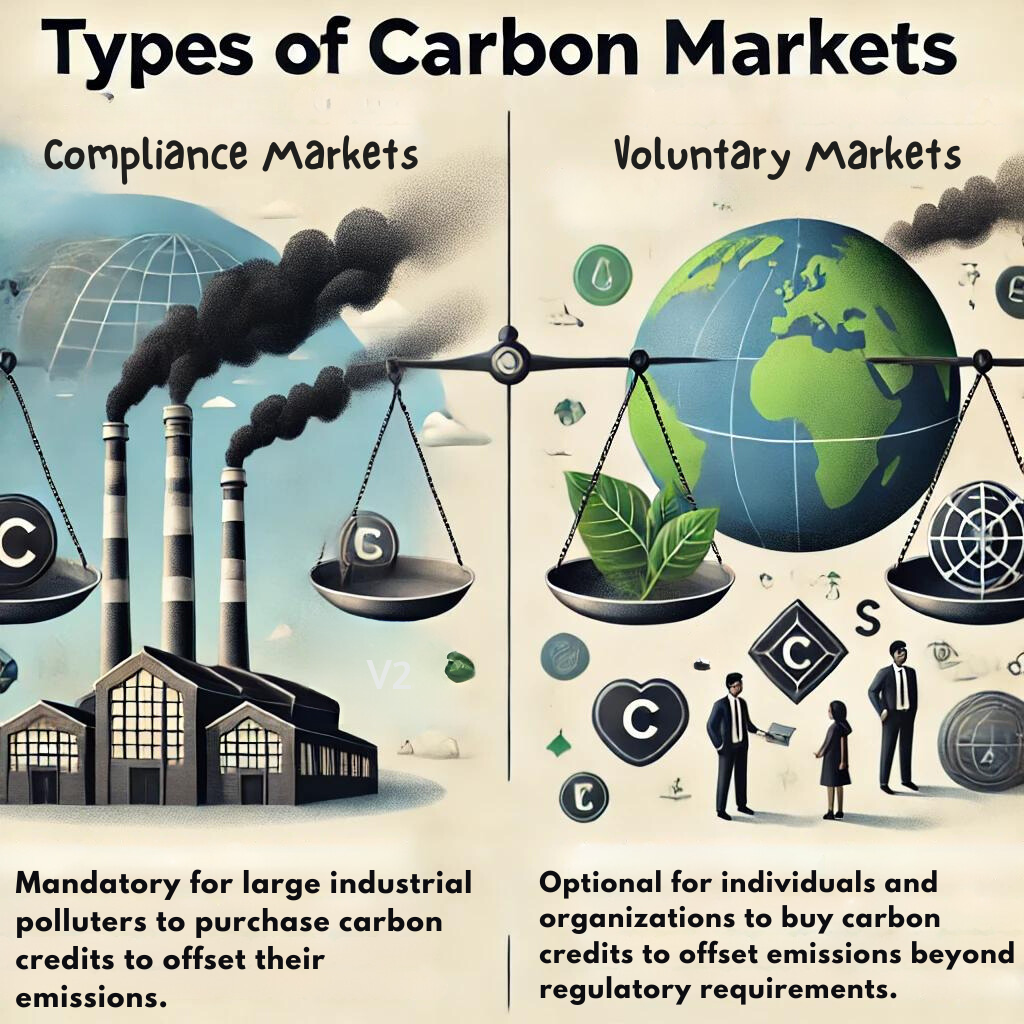

Types of Carbon Markets

Compliance Markets: These are mandatory markets where regulated entities, often large industrial polluters, purchase carbon credits to offset their emissions.

Voluntary Markets: In these markets, individuals and organizations voluntarily purchase carbon credits beyond regulatory requirements to offset their emissions.

Carbon Credits

Carbon credit is a reduction of greenhouse gas emissions one can trade, whereby one credit is equivalent to one ton of CO2 equivalent saved or reduced. Such credits could be earned through very many activities, for instance, the employment of energy-efficient technologies. It means the move toward renewable energy and reforestation.

Carbon Taxes

Carbon taxes are direct levies on emissions of greenhouse gases by people who pollute, charging them some money based on their emissions. They generate revenue for the government and can, in turn, be used to fund projects aimed at climate mitigation and adaptation. Thereby, incurring financial disincentives for high emissions.

Global Trends in Carbon Markets

As of August 2023, there are 74 carbon pricing mechanisms globally, including carbon taxes and emissions trading schemes. According to the World Bank’s “State and Trends of Carbon Pricing 2024” report, carbon pricing revenues reached a record USD 104 billion in 2023. Thereby, highlighting the increasing global emphasis on market-based solutions to climate change.

Current Government Initiatives Related to the Carbon Market in India

Carbon Credits Trading Scheme (CCTS): Launched under the Electricity Conservation Act 2001, and the Environment (Protection) Act 1986, the CCTS aims to reduce GHG emissions by trading carbon credit certificates. The compliance segment will start in 2025-26.

Other Existing Schemes: The Perform, Achieve, and Trade (PAT) scheme and the Renewable Energy Certificates (REC) system are additional market-based emission reduction initiatives.

Monitoring and Verification: The Bureau of Energy Efficiency (BEE) and the National Steering Committee for Indian Carbon Market (NSCICM) ensure the integrity of carbon credits through rigorous monitoring, reporting, and verification.

Advantages of Implementing a Carbon Tax

Incentivizing Green Innovation: A carbon tax creates financial incentives for businesses to reduce their carbon footprint, spurring innovation in clean technologies like renewable energy.

Revenue Generation for Climate Adaptation: Carbon taxes generate substantial revenue, which can be invested in climate adaptation and mitigation efforts. This is crucial for a climate-vulnerable country like India.

Improving Public Health: Reducing fossil fuel consumption through a carbon tax can improve air quality and public health, leading to reduced healthcare costs and increased productivity.

Consumption Consciousness: Carbon taxes raise awareness about the carbon footprint of products, influencing consumer behavior towards more sustainable choices.

Major Challenges Related to Carbon Taxation in India

Economic Impact on Industries: A carbon tax could increase production costs in energy-intensive industries, affecting their global competitiveness.

Regressive Nature-Burden on Lower-Income Groups: The tax may disproportionately affect lower-income groups who spend more on energy, exacerbating economic inequality.

Limited Scope: Carbon taxes may not address other greenhouse gases like methane, requiring additional policies for comprehensive emission reduction.

The Informal Sector Conundrum: Tracking and taxing emissions from small, unregistered businesses in India’s large informal sector is challenging.

Inter-State Disparities: Varying levels of industrialization and energy mix across states complicate uniform carbon taxation.

Carbon Leakage: Industries might relocate to areas with laxer regulations, undermining the tax’s effectiveness.

International Trade Implications: Stricter environmental standards in other countries could impact Indian exports, especially with mechanisms like the EU’s Carbon Border Adjustment Mechanism.

Measures for Effective Establishment of Carbon Market in India

Phased Implementation Gradual Greening: Adopting a phased approach to carbon taxation allows industries to adapt without economic shocks.

Border Carbon Adjustments- Leveling the Global Playing Field: Implementing border carbon adjustments can protect domestic industries and comply with international trade rules.

Technology Transfer Incentives-Bridging the Innovation Gap: Incentivizing the adoption of clean technologies, especially for SMEs, can bridge the innovation gap.

Green Lanes for Carbon-Conscious Industries: Creating a tiered regulatory system with benefits for industries reducing carbon emissions can accelerate technology adoption.

Carbon Credit Cooperative for SMEs: Establishing a cooperative framework for SMEs to participate in the carbon market can drive grassroots emission reduction.

Carbon Tech Incubators for Homegrown Solutions: Supporting startups developing indigenous carbon reduction technologies can foster innovation.

Green Finance Revolution: Establishing a green finance ecosystem, including green bonds and sustainability-linked loans, can support the carbon market.

Integration with Existing Schemes: Integrating the new carbon market with existing schemes like PAT and REC ensures policy coherence and enhances market liquidity.

Conclusion

India is at a pivotal moment, where establishing a carbon market can effectively balance its climate goals with economic development. By strategically designing this market, integrating existing schemes, and encouraging innovation. India can position itself as a global leader in sustainable growth. As India moves towards a low-carbon future, now is the time to act decisively and lead the way in creating a resilient, climate-conscious economy.